Hello, Niagara!

Shawn DeLaat here with the Davids & DeLaat Real Estate Team with your September 2023 Market Update.

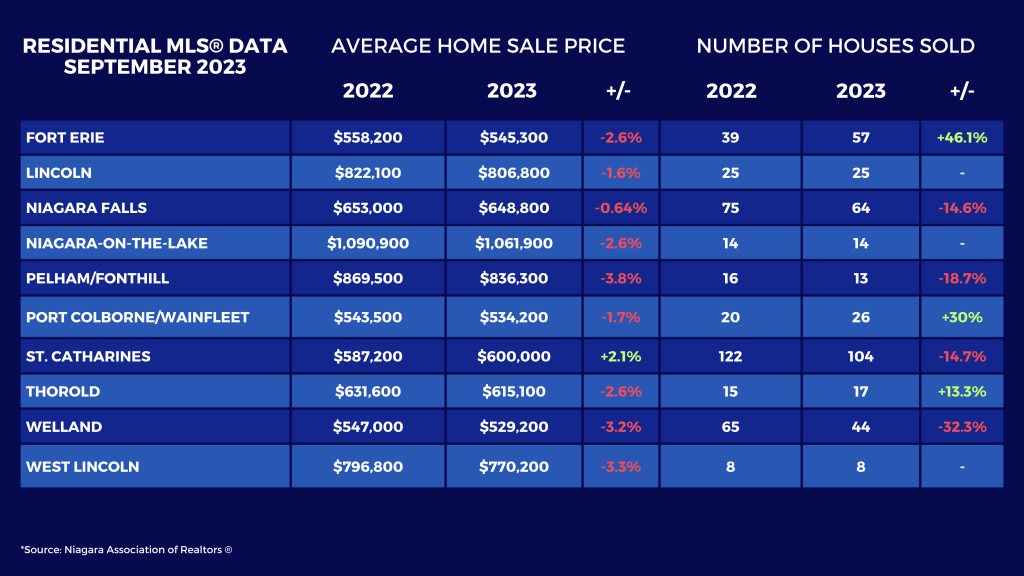

I like to kick off with a quick recap of the year so far. While January and February began somewhat sluggishly, the government and the Bank of Canada indicated they might hold off on rate adjustments until September or October. This boosted confidence, resulting in a vigorous spring market. However, in a twist, rates were raised in June and July, which has significantly stirred the real estate market. Now in September, the Bank of Canada has decided to maintain the current rate, further complicating the market landscape.

Our market is still grappling with the consequences of the June and July rate hikes, driving market activity downwards. Additionally, there’s speculation about another rate increase by the end of October.

WHAT DOES THIS MEAN FOR SELLERS?

If you’re expecting a specific return, the current market might not meet your expectations due to these interest rate changes suppressing prices. If you’re contemplating holding off until spring, consider this: if the rates rise in October, the market might dip even further. Consequently, spring prices might be lower than this year’s.

For those who bought in 2021, your property’s value is likely around the purchase price. With another rate hike looming, we could see prices decrease even further.

If you’re selling with plans to buy, it’s crucial to understand that if your house’s value drops, so does the one you’re looking to purchase. You need to decide whether selling now is a necessity or a choice. If it’s the latter, it might be wise to wait for a market correction.

WHERE ARE WE NOW? SEPTEMBER 2023 MARKET STATISTICS

WHAT DOES THIS MEAN FOR BUYERS?

When considering affordability, is it about mortgage rates or house prices? In truth, it’s about manageable monthly payments. High interest rates currently keep prices relatively low. However, if rates drop, property prices will rise, maintaining a similar monthly payment.

A potential market dip this winter might present a golden opportunity. With the recent rate hikes and the prospective one in October, I foresee prices dropping. This, combined with increasing inventory from sellers eager to make a move, results in a promising scenario for buyers.

WHERE OUR MARKET STANDS

Selling in this market demands competitive pricing. To ensure a sale, consider setting an aggressive price or being open to lower offers. New buyers will benefit from these conditions.

Sellers, reach out to Davids & DeLaat to navigate this market effectively. Whether selling is a necessity or a preference, we’ll guide you through the optimal selling strategy.

To all the potential buyers out there, now might be the prime time to buy. As interest rates drop and house prices rise, you stand to gain from home equity. If you’re keen on maximizing returns, now is the time to act.

In conclusion, sellers, the scales are currently tipped towards a buyer’s market. To make a sale,strategic pricing is crucial. As for buyers, the current landscape offers excellent opportunities. Dive in and secure your new home.

Contact us to discuss a selling strategy that’s custom fit for your home. Visit us on Youtube to learn more about these changes or schedule your free home evaluation to find out what your home could sell for in today’s market.