Hello, Niagara!

Hello, Niagara! I’m Shawn DeLaat from the Davids & DeLaat team, bringing you the comprehensive real estate market update for April 2024!

MARKET DYNAMICS:

As spring unfolds, we’ve seen a predictable increase in housing inventory. Homeowners who achieved sales last year are re-entering the market, and we’re encountering new listings from those facing financial pressures. By mid-April, inventory levels significantly rose. While March experienced positive momentum with slight increases in sale prices, shorter days on the market, and a slight uptick in sales volume, the surge in listings by April indicates a potential softening in sales activity in the coming months as buyer demand begins to wane.

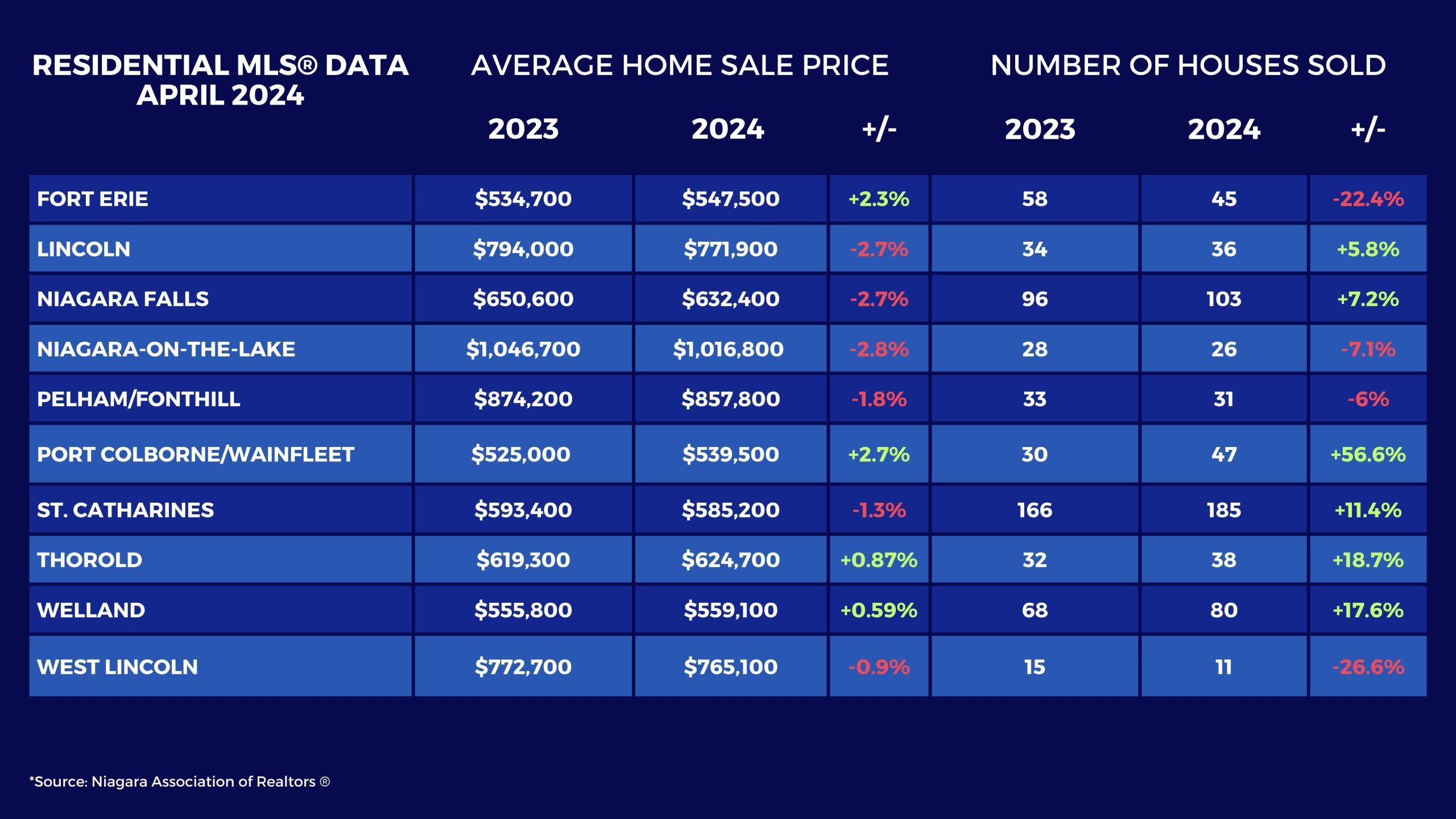

WHERE ARE WE NOW? APRIL 2024 MARKET STATISTICS

CURRENT MARKET STATUS:

The market continues to be lively for sellers who are realistic about their pricing strategies. Interest rates are currently steady at 5%. Buyers and sellers must operate based on the existing market conditions rather than speculating on potential rate changes. Despite a flourishing market, many sellers are attempting to stretch the market by setting higher prices, but it’s clear the market dynamics are shifting towards favouring buyers.

ADVICE FOR BUYERS & SELLERS:

Approximately 75% of potential home buyers have decided to pause their purchase plans this year, possibly waiting until next year. This scenario offers a unique opportunity for buyers ready to act now, potentially facing less competition. For sellers, especially those planning to purchase another home, market conditions still provide relative advantages—everything is relative. Sellers aiming for high returns might consider postponing their sales until next year when demand could rebound. However, everyone must recognize and accept where the market stands, adjusting expectations and strategies accordingly.

LOOKING AHEAD:

As we continue through 2024, keeping an eye on economic indicators and interest rate trends will be essential for navigating the real estate landscape. Both buyers and sellers should stay informed and be prepared to adapt to any shifts in the market. Working with experienced realtors who understand these dynamics can provide significant advantages in achieving your real estate goals, whether buying or selling.

Stay tuned for more updates, and feel free to reach out with any questions about your specific real estate needs. Here at Davids & DeLaat, we’re committed to guiding you through every step of your real estate journey.

Contact us to discuss a selling strategy that’s custom fit for your home. Visit us on Youtube to learn more about these changes or schedule your free home evaluation to find out what your home could sell for in today’s market.