Hello, Niagara!

Shawn DeLaat here with the Davids & Delaat Real Estate Team and this is your October 2022 market update.

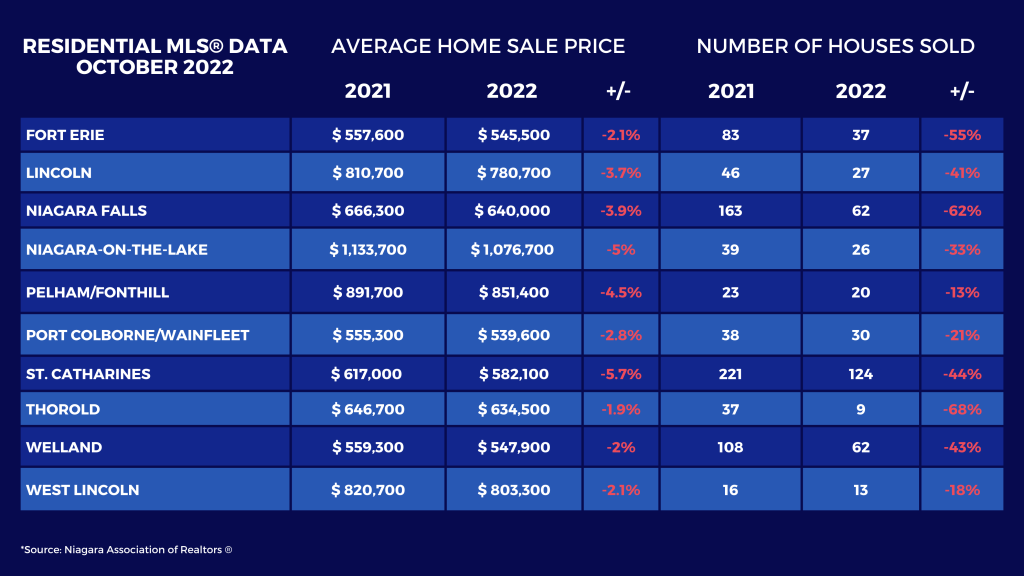

The Bank of Canada has been back at it again, and they have raised interest rates another 50 basis points. We’ve now experienced 6 continuous months of interest rates being raised and it has been compressing prices for us. Prices have begun to settle, but what we’re noticing is that there is a bottom of the market coming. Interest rates have slowed in the amount that they’re being increased, though we are anticipating a few more interest rate hikes. That said, we’re also anticipating that they won’t be as large as previous interest rate hikes. This means that the Bank of Canada is getting a little more confident in what’s going on and with what they’ve been doing to counter inflation.

THE IMPORTANCE OF PRICE IN THIS MARKET

Sellers are starting to become a little more palatable to understanding the market and accepting where the markets are at. Those sellers who are pricing their houses appropriately to the new pricing, which is a little more aggressive, are achieving sales quite quickly. There are a number of overpriced houses on the market, which means buyers, now is your time! I have to tell you, it is still a buyer’s market out there, but before you know it, I snap my finger like that and it is going to slowly start to shift.

SELLERS IN NIAGARA

Sellers, well, we’re at the point now where there is a new real estate market and the prices have dropped. So, if you can accept where the new prices are at; get out there and play ball! There’s plenty of opportunities, especially for those who are looking to sell and to buy. BIG WINS! – Big wins in the sense that you’re still getting a good value for your home and you’re going to get a good buy on the home you’re purchasing in-turn. For those sellers who are waiting in the weeds to see what happens, you might be waiting another year or two and we’ll keep you updated on that. BUT, the opportunities out there to buy right now are fantastic.

WHERE ARE WE NOW? OCTOBER MARKET STATISTICS

BUYERS, IT’S YOUR TIME.

The time to buy is now! Make sure you go get pre-approved. A fixed rate through the big banks is currently sitting roughly around 5.5/5.6 per cent. Do your due diligence, meet with a financial advisor and/or a mortgage broker to discuss your options and get out there and buy a house. Prices have come down, your down payment is less, your land transfer is less. PLUS, with these prices, your mortgage payments would actually be less than what they would have been in January and February if you bought at the height of the market.

HOW TO NAVIGATE THE NIAGARA MARKET

As mentioned previously, if you are looking to buy, do your due diligence, get out there and purchase a home now! For any individuals who are looking to sell their home but want to wait for the big ticket number, be patient waiting a few years.

If you have any questions or concerns regarding the market please don’t hesitate to contact a Davids & Delaat representative. We’re always happy to assist and connect you with our extensive network of industry-leading mortgage partners that can help you get pre-approved. As well, sellers, don’t hesitate to contact us to discuss the market, the value of your home and potential future plans.

Take advantage of the opportunity to purchase at a more affordable price! Contact us to discuss a selling strategy that’s custom fit for your home. Visit us on Youtube to learn more about these changes or schedule your free home evaluation to find out what your home could sell for in today’s market.